Company Overview:

SPRL is a leading manufacturer of Pistons, Piston Pins, Piston Rings, and Engine Valves in India, and belongs to the Shriram Group. Its products are marketed to renowned OEMs and in aftermarket under the brands SPR and USHA, catering to domestic and international markets.

Business Model:

i. Value proposition: Products being offered includes Pistons, piston pins, piston rings, engine valves, cylinder liner

ii. Unique Selling Proposition(USP):

Manufacturing lines are fungible.

5 assembly lines were set to meet just in time demands of our customer efficiently.

Our access to cutting-edge technology is complemented by four long-standing technology collaborations with prominent global leaders in the automotive components sector.

Catering to diverse range of product segments like commercial vehicles, PV, Two and Three wheeler, railway engines, defence applications

Cater to Marquee clients includes giants of auto industry Leading position as exporters of our products with a presence in over 45 countries spanning five continents.

Long-term relationships with leading original equipment manufacturers (OEMs), reflecting trust and reliability in their products.

Long-standing reputation through its brands USHA and SPR in the industry with a legacy of trust and reliability. Ability to provide customized solutions tailored to specific customer requirements.

SPR offers a comprehensive package, including design, development, validation, and manufacturing, catering to specific customer needs.

Management Team:

i. Mr. Pradeep Dinodia: Chairman (Non-Executive Non-Independent Director)

Board member: Since May 2003

Education: B.A. (Hons) Economics, St. Stephens College; Law Degree, Delhi University Professional: Fellow Member, ICAI; Chairman and Managing Partner, S.R. Dinodia & Co. LLP

Other roles: Director at Hero FinCorp Ltd., DCM Shriram Ltd., Hero MotoCorp Ltd.

ii. Mr. Luv Deepak Shriram: Whole-Time Director

Board Member Since: April 2009

Education: B.Com, Shriram College of Commerce

Expertise: Management and Finance

iii. Mr. Krishnakumar Srinivasan: Managing director and CEO

Education: B.E. Mechanical Engineering, M.B.A., PG Diploma in Export Management

Experience: Over 37 years in the automotive industry; known for strategic and hands-on leadership

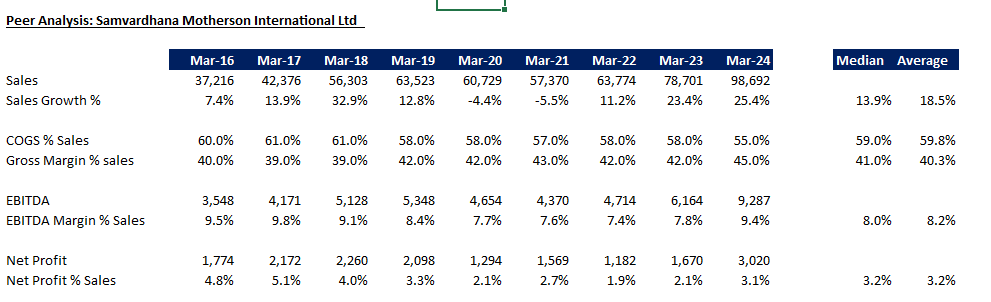

Financial Performance:

Revenue and Profit Trends and Margins:

Global Gross Margin 16.86%

Indian Gross Margin 38.34%

Emerging Markets Gross Margin 17.72%

Conclusion:

Shriram Pistons and Rings Limited has outperformed Indian, global and emerging markets in terms of gross margin. It has shown gross margin on an average level of 65.75%.

Due to supply chain realignment and improving capacity utilisation, working on multiple multimodal systems of power supplies, and bringing in a lot of operational efficiencies and improving productivities were the major reasons behind operating margin improvement.

During past 10 years company's gross margin has decreased from 68% to 59%. Reasons are: Continuously working on improving bleeders and improving overall mix in the portfolio to supply newer designs required for BS6 application.

Capex details:

Greenfield expansion = EV in Coimbatore - invested almost INR70 crores further beyond our investment to the company where we are putting in for new capex and new, lines that we are putting up there, including building up a brand-new plant in Coimbatore. The INR70 crores will be mostly spent in FY25, as I see.

Invested = Rs 70 crore … Expected to invest in FY25 = Rs 70 crore

Brownfield expansion = continuously work on, newer technologies like the hydrogen pistons, piston for hydrogen applications, pistons with hydrogen blended CNG applications. All this undergoes, the piston undergoes a massive change with the change in the fuel and we have to continue to invest in these capex.

Capex / CFO = 28.7%

Shriram Pistons & Rings Limited has outperformed the markets and its peers with gross margin on an average of 59.6 percent and cash operating margin of around 20.8 percent and with net profit of 14.2 percent.

Market Position

1. Auto Components Industry Analysis:

India Position

>> India is one of the key beneficiaries as global OEMs seek to de-risk their supply chain following the disruptions in the last few years (i.e. chip shortages).

>> Government Initiatives: Government push to tightening regulations to get the industry in sync with global standard (like transition of BS 4 to BS 6) 100% FDI allowed under automatic route for the auto components sector Government focus on ‘Make in India’ though various initiatives and schemes like PLI Scheme & FAME II which is driving EV transition

>> Indian Automobile market is expected to grow in the range of 6-8% CAGR. >> Significant cost advantages which allow auto companies to save up to 25% on operations as compared to Europe and Latin America.

>> India’s large population of skilled & semi-skilled workforce bodes well for the labour-intensive Auto & Auto Components industry

Electric Vehicle:

India Position

>> Government focus shifting on electric cars to reduce emissions.

>> Market size for EV-based components is expected to rise to Rs. 640-680 bn by 2030F, from an estimated Rs. 140-150bn in FY25E, as per Industry Reports.

>> By 2030, the government has committed that 30% of the new vehicle sales in India would be electric.

>> The High Adoption scenario is the is the 30% EV Penetration, as targeted by Niti Aayog.

Internal Combustion (IC) Engines will continue to grow with the growing Automotive Industry eventhough EV Industry is witnessing a boom because of the ongoing challenges faced by Electric vehicles.

Challenges in EV are:

>> According to a report by Brookings, in 2030, if 33% of the total auto sales are EV, there would be an electricity demand of 37,000 GW. Currently , India had an installed generation capacity of 4,26,132 MW in 2023, which shows

how behind the country’s grid is to support electricity demand from EV & EV Infrastructure>> 60% thermal power being generated today is not fully sustainable.

>> India has committed to 50% Renewable energy by 2030 with production to increase by 500GW.

>> The correct way of disposing off used batteries will be a challenge.

>> The framework that has been a success in the West and China cannot be applied to India due to the different demographics in India.

>> Higher cost of EV technology and unavailability of several components in India.

>> Very few charging stations in cities apart from few Metros; Malls and Office spaces also lack infrastructure making it challenging for daily commuters.

>> High Replacement Costs & Miniscule Maintenance Network

Market Share:

Shriram Pistons and Rings Limited has the highest revenue market share of around 47.3% among its peers.

Source: Emkay Research report

Growth Drivers and Strategy:

Expansion Plans:

>> In the process of building a state-of-the-art manufacturing facility near to existing facility in Coimbatore.

>> Capex of INR 700 million spending it in Coimbatore for growing our electric vehicle portfolio along with MOU that has been signed with the Tamil Nadu government with a new plant coming up in Coimbatore.

>> Advancing towards EV powertrain business

>> Technical collaboration agreements with GLE Motors and Lingbo Controllers, helping us in developing certain India related applications. Also Collaborating with partners for new technologies like CNG, ethanol blending, and hydrogen pistons.

>> Planning for capex infusion into various segments like hybrids and the non-EV applications like the flex fuels etc.>> New manufacturing plant operational at Pithampur facility (Madhya Pradesh).

Mergers and Acquisitions:

>> SPR, through its 100% subsidiary SPR Ingenious Ltd., has acquired a 66.42% stake in SPR EMF Innovations Pvt. Ltd. (EMFi). This strategic acquisition allows SPR to enhance its electric vehicle (EV) offerings, ensuring a move towards a more electrified product portfolio.

>> SPR has also acquired a 62% stake in SPR Takahata Precision India Pvt. Ltd., through SPR Engenious Ltd. This company has a technical collaboration with Takahata Japan, a global leader in precision injection moulded parts manufacturing.

Risk Factors:

Industry-Specific Risks:

>> Ongoing challenges faced with adoption of EVs

>> The Red Sea crisis is significantly impacting the multi-billion-dollar India’s auto components industry.

>> Delivery times for containers have doubled, ports like Singapore are congested, and freight rates have risen sharply as ships take longer routes for safety.

Financial Risk:

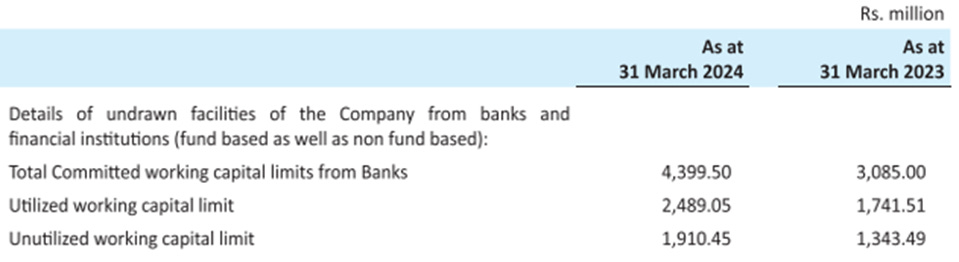

i. Credit Risk:

>> Increase in amount of provision provided for trade receivables from Rs 2.05 million to Rs 5.21 million.

ii. Liquidity Risk:

Valuations:

Source: Emkay

Recent Updates on Industry:

India’s auto component industry achieved a turnover of INR 6.14 trillion (US$73.1 billion) between April 2023 to March 2024. According to a recent industry report, this represents a 9.8 percent increase from the previous year.

The domestic Original Equipment Manufacturing (OEM) component supply grew by 8.9 percent to INR 5.18 trillion (US$61.7 billion), the EV manufacturing sector contributed 6 percent to total production. India’s auto components exports rose by 5.5 percent to US$21.2 billion in FY 2023-24, while imports increased by 3 percent to US$20.9 billion, resulting in a US$300 million trade surplus. India’s aftermarket segment, valued at INR 938.86 billion (US$11.1 billion), saw a 10 percent increase.

The government had launched an e-bus program where 50,000 e-buses were targeted to be put on the road. “We have about 23 lakh buses out of which only 1.5 lakh are of the STUs (State Transport Undertaking) and the rest are of private sector. We have about 12,000 electric buses which are on the road in India now which is a good beginning but certainly a very small pie of the entire cake. The demand for the advance chemistry cells is going to be a very aggressive demand for the auto components industry to grow.